Many people who purchase Bitcoin at its current price are wondering whether its value will appreciate in the last quarter of the year. With a turbulent year for all investment markets, uncertainty is more present now than ever before.

In this article we explore where Bitcoin will be by the end of 2020 and all the possible scenarios that could affect its price. After reading this post, you should be able to make better financial decisions.

Bitcoin’s price performance YTD

When looking at Bitcoin’s price all throughout 2020, what we see is a lot of volatility and uncertainty that is primarily linked with the financial crisis we may be entering soon, due to the COVID19 pandemic-related lockdowns.

Earlier in the year, Bitcoin continued an upward price momentum that saw it peak close to the $11.000 range in the middle of February. Shortly afterwards, the price experienced a massive drop.

February was an eventful month, as the world came to know that COVID19 had caused a lockdown in China, which could possibly expand to a worldwide level, destroying many jobs and small businesses along the way. The price started to drop somewhat rapidly to the $8000 area.

On March 11th, the WHO announced the pandemic status of COVID19. Moments after the announcement, the all investment markets started to sell off and cryptocurrencies followed suit. The drop happened as an extremely rapid pace, and Bitcoin lost over 50% of its value in a 2-day period. With its yearly lows touching just under $4000, many investors saw this as an opportunity to finally stand up from the sidelines and join the market.

The 2-month period ensuing the worldwide lockdowns, Bitcoin recovered faster than any other investment market and is still, to this date, the best performing investment opportunity in 2020.

Over the course of the summer and early fall, we saw the cryptocurrency peaking at $12.400 before subsequently dropping back to the mid $10.000 levels.

And this is where we currently stand. Over the past week, we had several events cause FUD to the market, but no substantial change in Bitcoin’s price. For one, we received news that BitMex was operating an illegal money laundering scheme and is now being eyed by the federal bureau of investigation.

Additionally, we have COVID cases increase rapidly over the past few months, with the highlight coming just a few days ago, when US president Donald Trump announced that he, and presidential candidate Joe Biden, were infected by the virus.

If we can say anything about the year-to-date performance of Bitcoin, we could assume that the worst is over, since the cryptocurrency barely saw a 5% decrease in price as a result of the above news. “Weak hands” seem to have sold already a while now, and more institutional investors are currently entering the game with the goal of holding their coins for longer periods of time.

EOY outlook — Will Bitcoin break its ATH?

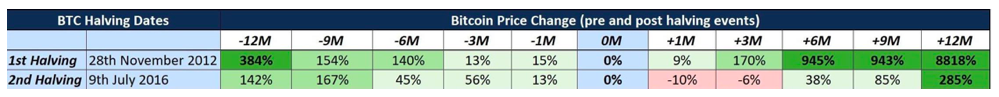

After the Bitcoin Halving, the price of Bitcoin has appreciated significantly and follows suit with the historical performance of past halvings. Expert investors from all over the world claim that Bitcoin in on its way to break through its past all-time high before the end of the year. But is this a realistic scenario?

To understand this, we would need to cautiously explore how Bitcoin ended the year during its previous halvings, and compare this with where we stand at the moment.

We are currently (almost) 6 months past the 2020 halving, and Bitcoin is currently trading 20% higher than its price during the past halving ($8853->$10.600). If, during the next couple of weeks we see Bitcoin at the $12.000 level again, we would have a confirmation that the cryptocurrency is trading with the exact same percentage gain post halving, as compared to the previous halving. Of course, the best part comes during the final few months of the year.

The past halvings saw a 943% (2012) and 85% (2016) price growth after a 9-month period. If we are to see Bitcoin repeat these numbers during this halving, we would see the cryptocurrency at either $82720 or $16200 respectively. Naturally, the volatility of the market slows down as more people add to the coin’s liquidity. This means that, realistically speaking, even an 85% gain since its halving date would be extremely optimistic given the current market conditions.

However, this time around, a lot of interesting developments have been occurring in the crypto space. Not only do we have a lot more financial products being matched to the crypto markets (staking, savings accounts, interest yielding accounts, etc.) but we are also seeing a growth in decentralized exchanges. This means that more and more people are able to participate in the crypto markets without any regulatory overview, trading as they seem fit without having to answer to anyone. Due to this, we believe it’s absolutely realistic for Bitcoin to break past its all-time high before the end of the year and even see a significant amount of growth during this period.

Of course, for this assumption, we are not taking into consideration any challenges that could come up along the way. Those could include new potential lockdown measures or limited access to cryptocurrency exchanges due to new regulations.

Overall, we will need to wait and see how the market performs over the next few months. So gear up, cause chances are that we are going up!