With their prices are soaring to new highs, cryptocurrencies are back under the spotlight. Investors are once again scrambling to buy Bitcoin and altcoins to avoid missing the expected price rally in the next year.

And with the price increase, cryptocurrency mining has returned to the stage as a great way to acquire new coins. However, the market is always changing and it’s not always easy to know which are the most profitable coins to mine.

In this article, we go through some of the basics of cryptocurrency mining, provide you with a list of the best cryptocurrencies to mine in 2021 as well as some resources that will help you calculate your profits beforehand. Let’s get started.

What is cryptocurrency mining?

Cryptocurrency mining is the process of verifying transactions on the Blockchain. At the same time, this process secures the network and provides a means of issuing new coins. This consensus method of verifying transactions is called Proof-of-Work (PoW).

Mining is done by solving complex mathematical problems (or hashes) through the computing power of powerful computers called mining rigs. Miners spend energy (electricity) to get rewarded with new coins.

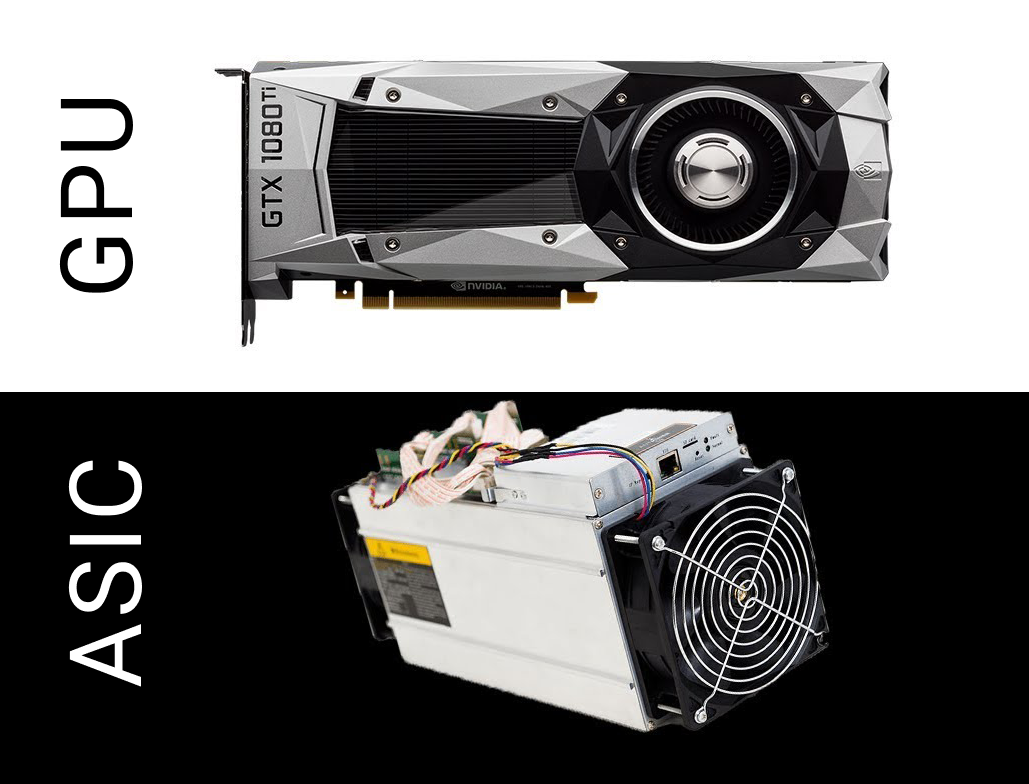

ASIC or GPU cryptocurrency mining?

Mining rigs are usually separated into two categories:

vASICs (application-specific integrated circuits) — computers specifically designed to mine cryptocurrencies. They are very powerful, but also expensive and require a lot of energy to run. Notable cryptocurrencies that can be mined with ASICs are Bitcoin, Bitcoin Cash, Litecoin, etc.

GPU (graphic processing unit) rigs — these machines use the combined power of multiple graphics cards to solve the mining puzzles. They are used to mine ASIC-resistant cryptocurrencies such as Ethereum, Monero, Bitcoin Gold, etc.

How to calculate mining profitability

You should know that there are a few factors to consider mining. After all, if you are getting into mining, it should be for making profits. Always keep the following elements in mind and act accordingly to avoid mining at a loss:

The price of cryptocurrency — this is an important metric that you should be following at all times when mining cryptocurrencies. Cryptos are volatile assets and their price can drop significantly, reducing your profits or even putting you at a loss.

Your running costs — the price of electricity in your region will be your main factor for this metric. To this, you can add maintenance costs for your rigs, such as cleaning and replacement parts.

The power of your rig (hashrate) — the higher the hashrate of your mining rig, the higher your chances to receive rewards will be.

That being said, you don’t have to calculate your profitability manually. There are many calculators online, such as Cryptocompare and Whattomine that will do it for you once you input the aforementioned metrics.

Should you mine Bitcoin?

There’s no secret that Bitcoin is the most popular and valuable cryptocurrency on the market. With more than 60% of the market share, it’s clearly a giant in the sphere. So it’s only natural to ask yourself if you should be mining Bitcoin.

That being said, this popularity has also drawn mega-mining farms into the picture. These corporations hoard enormous amounts of hashing power and leave little to no room for any kind of competition.

Furthermore, by design, Bitcoin’s mining algorithm adjusts its difficulty and new coins become harder to mine as more miners join the race.

And finally, ASIC rigs are very expensive and difficult to buy in the retail market.

These combined facts have made Bitcoin mining unprofitable for the average mining entrepreneur. But hope is not lost. There are still a few coins that can bring decent revenue for aspiring crypto miners.

Top 3 coins to mine in 2021

Ethereum Classic (ETC)

Ethereum Classic emerged as a split version of the Ethereum's Blockchain, the other being Ethereum itself. The split occurred following a hack on Ethereum in June 2016, where $50 million worth of funds were stolen.

Bitcoin Gold (BTG)

Bitcoin Gold is a hard fork from Bitcoin that was designed specifically to be ASIC-resistant. One of the main reasons for its creation was to democratize mining and make it accessible to enthusiasts that want to build their own machines with GPUs.

RavenCoin (RVN)

Ravencoin is a fork of Bitcoin and is very similar to the original cryptocurrency. Through the Ravencoin network, users can create and transfer assets from one party to another. Ravencoin focuses on the privacy of its users, rendering transactions fully anonymous.

Conclusion

Cryptocurrency mining is a great alternative for acquiring new crypto and making profits. Just keep in mind to check often for running costs versus income to ensure you aren’t mining at loss.

Use mining calculators and check what coins are the most profitable and adapt your mining operation accordingly. If you follow these simple rules, mining should remain a good source of income in the upcoming future.

Also check our mining hardware category to choose best mining equipment!