The narrative in the cryptocurrency space has always been that this asset rarely requires any regulation. As such rules apply, you might find it shocking that U.S traders are taxed on the income they generate from trading these digital assets. If you’ve not heard it before, here it is: the Internal Revenue Service (IRS) taxes crypto traders in the United States as the asset is considered a property. If you find this phenomenon confusing or need a clearer understanding of how this works, then you should read this article till the end. We’ll be demystifying all there is to tax payment in the U.S. crypto community.

How Popular Are Cryptocurrencies in the U.S.?

Despite how much pushback and legal restrictions cryptocurrencies have witnessed in the United States, the global comparison perspective shows that this country is responsible for the highest accumulated revenue in the sector. Over 58% of Americans claim they have heard of cryptocurrencies, and 70% of the country’s states have enacted legislative laws that address these digital assets. In terms of figures, the U.S. market size was capped at $1.19 billion in 2022 and is projected to expand by 12% between 2023 and 2030. Rising awareness and increasing adoption are significant factors that have contributed to the popularity of these investments in the United States, and the general belief is that there is more of this growth to come.

How Does Crypto Tax Work in the U.S.?

Cryptocurrencies as digital assets are not taxable when you hold or own them, but the case is usually different when you sell, use, or trade crypto to make profits. The IRS considers these assets as properties that serve as a medium of exchange, a store of value, and investments that can be converted to real money. The body also treats them the same way as stocks, bonds, and other capital assets, and as such, taxes that apply to these investments also apply to cryptocurrencies. The money you make from your cryptocurrencies is taxed at different rates and in two categories: as capital gains or as income. Capital gains are when your asset increases in value and rises above the initial price, while income investments are interests and dividends made from these investments. The U.S. tax system applies to these two categories of taxable events.

Taxes on Capital Gains

Taxes in capital gains cut across diverse categories, like selling your coins for cash, converting from one asset to another and using your crypto to buy goods and services. If you make profits from selling your assets, you’ll owe taxes. However, you also get to deduct that loss on your taxes if you sell at a loss. When covering your investment, the usual approach is to sell for USDT or another stablecoin before buying the new crypto. Since this falls in the sale category, the IRS requires you to pay a tax. You'll get taxed on the transaction when using cryptocurrencies to purchase. Short-term tax rates for capital gains fall within 10%–37%. Long-term often comes in lower rates, ranging between 0%–20%.

Taxes on Income Gains

Taxes on income gains cut across every action where you generate money from these assets. The cryptocurrency market benefits its participants, so the list here is quite long. Taxes in this bracket include actions like:

- Getting paid in cryptocurrencies.

- Getting crypto in exchange for goods and services.

- Mining.

- Staking rewards.

- Earning from a hard fork.

- Airdrops.

- Other incentives.

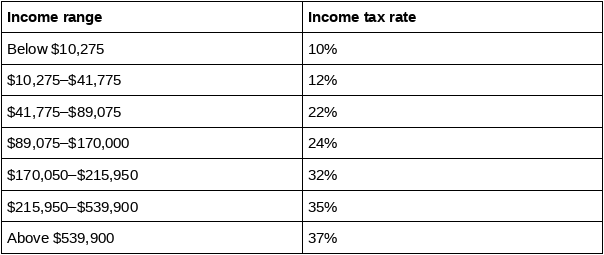

The tax bracket for income gains is calculated based on the income range detailed in the table below.

Are Taxes Different In Each State in The U.S.?

The rates in the previous paragraph are strictly federal rates used by the IRS. Cryptocurrency tax by state varies. Some states do not impose them, while others treat them as cash equivalent. Those that do not set them are regarded as crypto-friendly states, and some of them include Alaska, Florida, Nevada, and South Dakota. Lastly, those following the same approach as the IRS in categorizing these investments may use a different approach to determine the value attached to the crypto assets.

Minimizing Crypto Taxes for Higher Gains

One last question most users ask is how they reduce the tax brackets on their assets. Some strategies that can help are realizing profits in low-income years, taking advantage of long-term capital gains, and harvesting your capital losses, which can help offset some of your gains. Lastly, remember that all transactions on the blockchain are visible to everyone, and with contractors like Chainalysis, the IRS has been able to match anonymous transactions to investors.